Hi, I’m @tecomah in Sorare and passionate about data analysis. Two weeks ago I published my first article “How to value a Sorare Card"?” and I’d like to thank you all for the great feedback I received.

Today we shed light on a boiling topic on Sorare: wealth distribution. The goal of this analysis is to provide unbiased data elements, far from the usual whale bashing that we see on Discord and Twitter.

If you like this article, please help me give it more visibility by sharing it on Twitter.

Not yet on Sorare?

I) Wealth Distribution on Sorare

October, 2nd: at the time I’m writing this newsletter, 42176 managers have bought at least one card.

Based on the 1-month average price of cards, the total valuation of Sorare minted cards is 62kΞ - $200million.

More than 5k managers have a portfolio worth over 1Ξ.

0,1% frontier is at 175Ξ, 1% frontier at 20Ξ, 10% frontier at 1,44Ξ.

Once again, wealth distribution follows a strong Pareto law:

The top 1% of managers hold 45% of the total value, 89% for the top 20%. Bottom 50% currently held 4% of Sorare wealth.

To give a bit of context, this wealth concentration is not crypto-specific. Wealth distribution in the US is quite close.

What’s very specific to Sorare is the concentration of wealth for the top 1%.

II) Not all whales are the same

Whale: a metaphorical term that refers to large holders of Sorare cards, often subject to bashing on discord.

Let’s focus on the top 100 based on the Total cards 1-month average price provided by Sorare Data.

These 100 managers hold more than 42k cards worth more than 22kΞ - 35% of the total).

Mr.Karuppu has a portfolio worth 1607Ξ ($5.5 million), almost twice as much as the second-largest portfolio detained by Adotjdot. PawelTrader is the manager who owns the most cards -by far- with more than 19k cards (12k Limited, 6k Rare, 800 Super Rare, and 128 Unique). His gallery is a bit like Amazon: if you ever need one specific card, you can be sure that you’ll find it in PawelTrader’s gallery.

Historical Managers or newcomers?

18 of the top 100 managers started to play Sorare back in 2019, during the Beta phase of the game, or just after the official release. 32 of them started to play the game this year, including Antoine Griezmann aka Grizou.

4 of the managers in the top 10 are playing Sorare since the beginning.

Mr.Karuppu and PawelTrader, respectively the managers with the highest portfolio value and card numbers started to play later in 2020’Q3.

Different performances in the S05 Competition:

To compare managers we look at the % reward-winning lineups.

Most of the managers of the top 100 are quite close to the 20%, but there are some outliers:

The passive investors do not seem interested in the competition: less than 5% of their lineups lead to a reward.

The traders, who made probably made it to the top 100 thanks to specific trading strategies, and not through their S05 performances.

The S05 experts, that over-perform in the S05. The majority of them started to play Sorare back in 2019. They probably beneficiated from a less competitive era, but also probably gained experience and developed their expertise.

Looking at the specific position into the top 100, we see that the top 10 is quite polarized between one passive investor, one trader, and 8 S05 experts.

III) Started from the bottom, now they’re here.

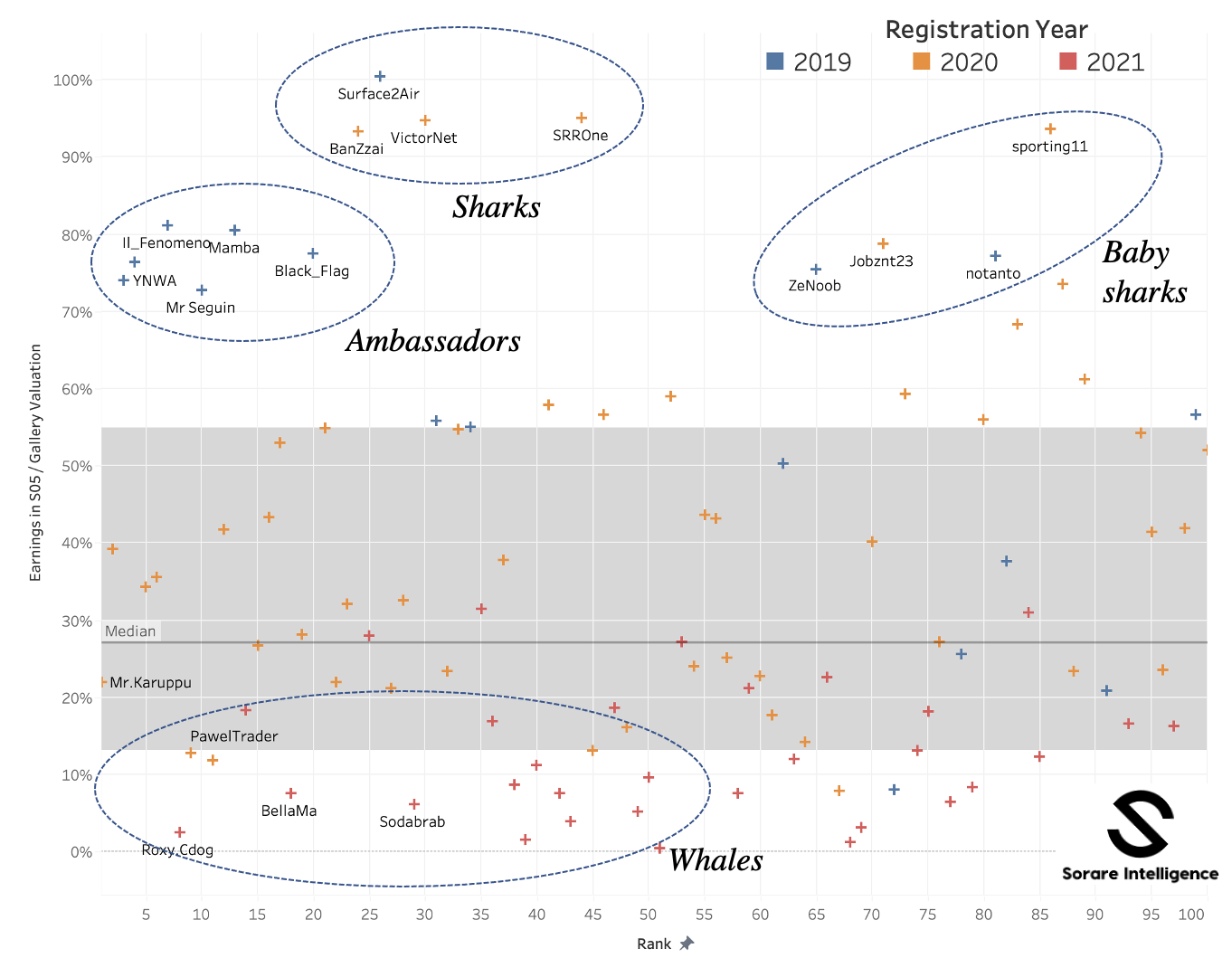

To compare S05 performances we look at the % of gallery valuation represented by ETH earnings + Total rewards current valuation.

A ratio of 100% means that the entire gallery is composed of rewards. In reality, the manager likely has already cashed out some of his earnings.

We can isolate some clusters when looking at this metric:

Ambassadors that started to play in 2019, at a lower entry fee, that managed to stay in the top 20 thanks to rewards.

Sharks, that started to play a bit later, with galleries composed at 90%+ of rewards.

Baby sharks that share the same description but are relegated after the top 50.

Whales that put a lot of money in the game in the last year, and won few rewards compared to their initial investment.

Notice that the median ratio is at 27%, which is a significant yield for users that joined for most of them this last year.

Conclusion

Sorare wealth distribution is very concentrated on the top 1% of managers. Early believers in Sorare still represent a significant part of them, and their wealth mostly comes from rewards accumulated those last two years.

I’d really like to do the same analysis in October 2022, and I bet that wealth distribution will converge towards a classical Pareto law.

All this data comes from Sorare Data, that we can’t thank enough for this amazing platform.

A special congrats to my friend Jobznt23 that left his job this week to launch his Twitch channel. (French speaker only for the moment).

I’ll try to publish an analysis every two weeks. Subscribe to receive them in your inbox.

Very interesting, do you have info regarding rewards, for example how evolved the ammount in ETH redistrubuted to managers that reached threshold 205 & 250 on a weekly basis?

Interesting stuff ! But this is a "survivor focus" study. I'd find very interesting to do the same for the 99% remaining players?